Pensacola Florida Homeowner Facing Foreclosure FHA Insured Loan

Pensacola Florida Homeowner Facing Foreclosure – FHA Insured Loan

The U.S. Department of Housing and Urban Development (HUD) has specific requirements for short sales under its **Federal Housing Administration (FHA)** guidelines. These requirements ensure that short sales (also called **Pre-Foreclosure Sales**, or PFS) are managed systematically and fairly. Here’s a summary of the key HUD-imposed requirements:

1. Financial Hardship Documentation

– The seller must demonstrate a verifiable financial hardship, such as:

– Job loss or reduced income

– Divorce or separation

– Significant medical expenses

– Death of a household member

– Increased expenses beyond their control

HUD requires thorough documentation to prove the hardship, including income, assets, and liabilities.

2. Owner-Occupancy

– Typically, the property must be owner-occupied.

– Exceptions may be granted for military relocations or other documented reasons preventing occupancy.

– For vacant properties, the seller must prove the vacancy was involuntary and did not occur due to investment intentions.

3. Default Status

– The mortgage must be in default or in imminent default.

– This means the borrower must already be delinquent or have clear evidence that they will not be able to make future payments.

4. Market Listing and Sale

– The property must be listed with a licensed real estate agent at fair market value.

– The listing cannot include:

– “For Sale by Owner” (FSBO) arrangements.

– Terms that restrict marketing to a specific group (e.g., cash buyers only).

– HUD requires an **arms-length transaction**, meaning the buyer and seller cannot be related or have prior arrangements.

5. Net Proceeds to Lender

– HUD sets specific guidelines for how much the lender must net from the sale, based on property value.

– Typically, lenders require a minimum net amount based on a percentage of the appraised value.

6. Seller Contribution

– Sellers cannot profit from the short sale.

– HUD prohibits sellers from receiving cash proceeds, but they may offer limited assistance to cover relocation costs (up to $3,000).

7. Appraisal and Valuation

– HUD requires an independent appraisal or broker price opinion (BPO) to determine the property’s fair market value.

8. Review of Offers

– The lender must approve the sale price and terms.

– Offers below a minimum threshold may be rejected.

– HUD requires prompt responses from lenders to prevent prolonged uncertainty.

9. Deed Restrictions

– In some cases, HUD may impose deed restrictions to prevent resale for a certain period or to limit profits on resale.

10. Mortgage Insurance

– If the FHA mortgage includes mortgage insurance, HUD will coordinate with the insurance provider for claim processing after the sale.

11. Fraud Prevention

HUD has strict anti-fraud rules. All parties involved must sign an arms-length affidavit certifying that there are no undisclosed agreements or benefits.

By following these requirements, HUD aims to ensure short sales are handled equitably while protecting the interests of all parties, including the homeowner, lender, and government. Speaking of government, don’t expect a quick turnaround on getting your short sale approved

*** When you proceed with a short sale you will not have any closing costs or commission.

If you are a Pensacola Florida homeowner, let’s talk about a solution go to my calendar here.

———————–

Pensacola Florida Market Snapshot

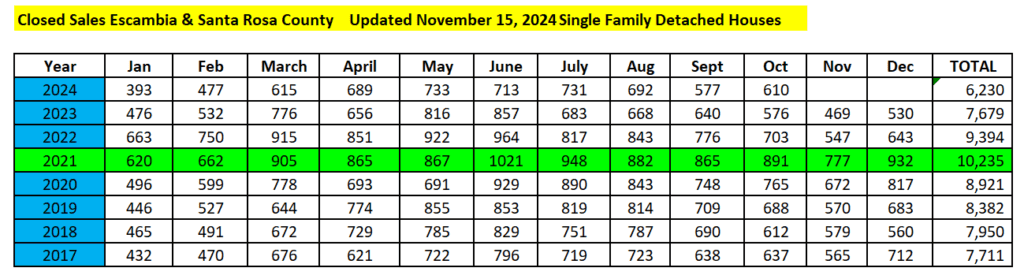

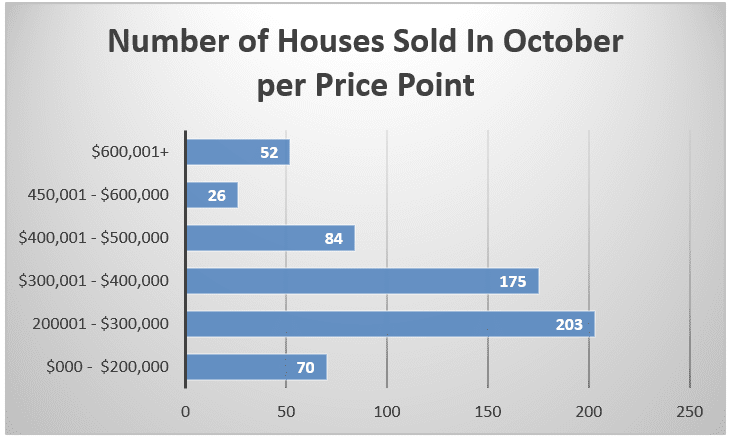

In October 2024, the Pensacola real estate market recorded 610 closed sales, with the $200,001 to $400,000 price range being the most active segment, accounting for 378 of those sales. This reflects ongoing challenges with affordability caused by factors like elevated mortgage interest rates, rising homeowners’ insurance premiums, and the increasing costs of daily living.

These trends are consistent with national and regional patterns, where affordability constraints have driven buyers toward mid-range homes. High borrowing costs and operational expenses have made higher-priced homes less attainable for many, while demand remains steady for more moderately priced properties. Builders and sellers in this segment often see quicker sales as these homes align with buyers’ budgets despite economic pressures.

Jack Lara, Broker-Associate

Epique Realty, Inc.

Serving Pensacola Florida since 1999

Joaquin Alberto Lara, LLC